The virtual black box of the automotive set, whether it’s vehicle plug-in technology or merely a cellphone app while motoring, may lower insurance rates for many drivers. But a new business study involving Washington University in St. Louis provides analytical theories showing that such driver-monitoring technology can not only prove beneficial to the bottom lines of some consumers, but also to insurance companies by alleviating moral hazards that affect the risks of accidents.

This research, titled “Effects of Monitoring Technology on the Insurance Market”and published in the March 2019 online edition of Production and Operations Management, provided an analytical framework to assess the impact of such tech on both drivers and insurance companies, said Baojun Jiang, associate professor of marketing at Olin Business School.

Whether it’s called telematics or usage-based insurance (UBI) information, these virtual tracking devices — plugged into a car’s on-board diagnostics port or deployed via an app — can lead to discounts, penalties, profits, zero growth … but, most importantly, information that leads to differentiation.

For most of a century, it has been an industry basing its premiums and risk factors on demographics such as age, marital status, occupation, residence (higher rates of accidents in your city or state?), mileage, even the model of vehicle along with limited accident and ticket information.

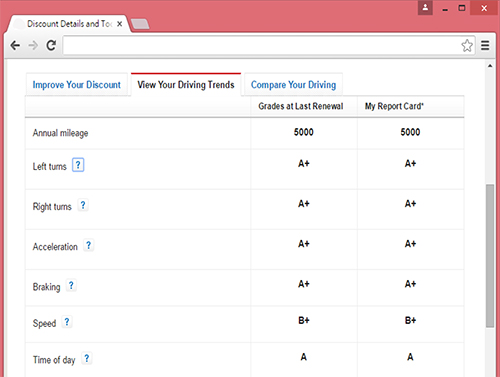

In the 21st century, however, these devices offer a purer form of market differentiation and segment demarcation through the information provided to insurance companies: daily details about braking and speeding and obedience of laws, driving behaviors, even behavioral modification — safer driving produces lower premiums and fewer accident payouts.

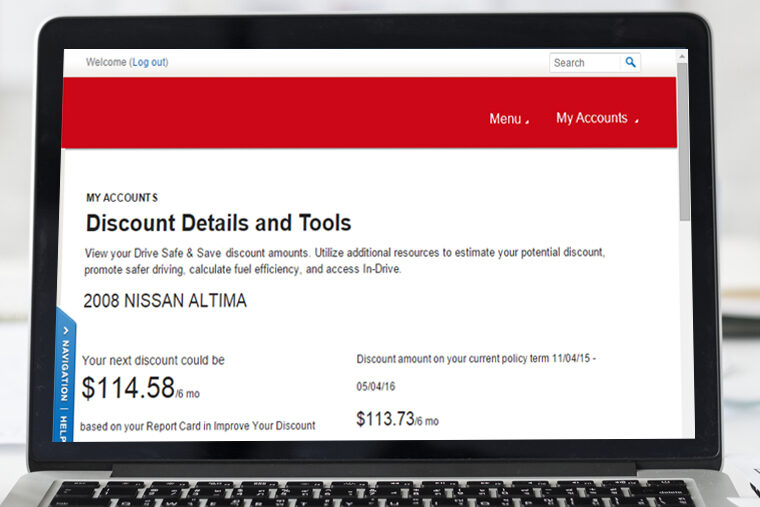

Insurance companies such as State Farm and Allstate have offered monitoring devices and monitored insurance contracts for a few years, and Nationwide recently began a form of it — partly based on lower mileage — in Illinois with plans to expand into other states and cities. In fact, Jiang’s co-author, Yu-Hung Chen, who earned his doctorate in economics under Jiang in Arts & Sciences and works at National Taiwan University, received a $113.73 discount on his insurance after monitored driving mostly with a child in tow … and their research in progress.(Anecdotally speaking, Chen knew a single male driver — the higher-risk pool per demographics — whose discount was roughly $5.)

“They install it in your car, and it records all your driving patterns: Where you have been? How you drive? Do you slow down when turning? Do you obey traffic rules?” Jiang said. “But not everyone has adopted it.

“Our paper shows if there are asymmetric adoption (i.e., only a select few using the monitoring), these present different facets to different companies. Some companies can market to lower-risks, lower-costs drivers — they can give these customers discounts. The high-risk, high-cost drivers are targeted by other companies. They can avoid directly competing for the same segment of customers, which can help them alleviate direct price competition.”

Neither drivers nor insurance companies are on equal footing in 2019, according to research reported by J.D. Power earlier this month that the auto insurance industry is earning more, as revenue reached $245 billion last year. And, around the same time, auto-insurance research engine The Zebra reported that four of every five American drivers are seeing a rise in their insurance costs — to $1,470 annually, a nearly 25% spike over the past seven years.

The devices allow insurance companies to reduce or remove problems such as “moral hazard,” for instance when a driver isn’t so cautious knowing he or she has coverage, and “adverse selection,” when there is a lack of information about buyers beyond the basic demographics. So armed, companies can track how safely (or not) people operate their cars or even motorcycles and boats, and, the co-authors wrote, “better identify the drivers’ risk types.”

Granted, some drivers will object to tracking devices being installed in their vehicles and sharing personal information.

“I personally have high-privacy concerns; I didn’t install it,” Jiang said, while Chen did use the tech. There also is the question, Jiang added, of who owns the data: “Do you, or does your insurance company? And what if you are in an accident?” he said.

The behavior-modification aspect of monitoring devices plays into the equation. It doesn’t translate into a cost or price, but rather societal benefits in the form of fewer accidents and safer roads.

“This causes people to make an extra effort to not drive aggressively and to pay more attention to traffic rules,” Jiang said. “But if it bothers you to invade your privacy, or if you don’t want to give that extra effort, don’t install it.”

The next step in research, Jiang said, would be a big-data dive into monitoring-device statistics across the industry.

“It would be interesting to have some data and see what the impact is,” Jiang said. “Controlling for other factors, did the company benefit? What happened to prices over time? Did the consumers benefit? Which segments of consumers?

“We don’t have the data,” he said. “But the insurance companies themselves, if they wanted to, they could do some studies. They have the data.”