The World Changers: These WashU women are making a better world

Social entrepreneurship at Washington University is strong with faculty, students and alumni creating change around the world. Here are four examples.

The Redefiner: Atima Lui

Founder and CEO of NUDEST, Atima Lui, sells software that uses machine-learning to match skin tone as a service to beauty and fashion brands.

Innovative women: Changing the world with ideas

WashU nurtures women entrepreneurs through training, mentoring, funding and real-world experience. This is their story.

A welcome message from Dedric Carter

Washington University in St. Louis is showcasing the talent and creative energy of some of our most innovative female innovators and entrepreneurs.

Don’t always credit/blame innovator behavior

A new study by a group of business school researchers, including Washington University’s Daniel Elfenbein of Olin Business School, used a computational model to interpret decision-making, learning and experiences that end in an entrepreneur’s success and failure in market entry and exit.

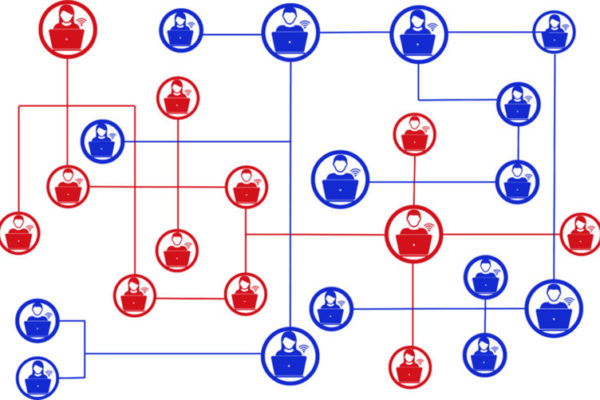

Red/blue-state divide even exists in eBay trading

An Olin Business School analysis of more than 550 million items sold by individuals on eBay in 2015 and 2016 — transactions totaling $22.3 billion — signals that we’re more likely to buy goods from someone we perceive comes from a similar political persuasion.

Olin students win global analytics competition

A team of five students in Olin Business School’s data analytics program prevailed over 44 other teams, taking first place in a global competition with a project that provided the National Multiple Sclerosis Society invaluable insight about its annual fundraising bike race.

Study: Passive investors facilitate activists’ ability to be aggressive

A new study led in part by Olin Business School’s Todd Gormley finds that increasing numbers of passive investors is encouraging activism targeted at board makeup changes, proxy settlements and the sale of the business or its parts.

Bank on morality

Olin Business School’s Daniel Gottlieb was part of a group of researchers conducting an economic behavioral study on how a consumer’s moral compass points him or her to repay debts. The group borrowed from Muslim teachings.

Three alumni re-design St. Louis’s Gateway Arch

Efforts of Washington University alumni proved pivotal in the transformation of the Gateway Arch grounds and museum. The only thing missing now, they say, is you!

View More Stories