Political instability is generally bad for the economy. It has the potential to cause uncertainty among investors, leading to market volatility, inflation and, eventually, slowed gross domestic product (GDP) growth.

At least in the short term, though, the U.S. invasion of Venezuela and capture of President Nicolás Maduro and his wife curiously has had little effect on the stock market.

Timm Betz, an associate professor of political science in Arts & Sciences at Washington University in St. Louis, said the markets have largely shrugged off the geopolitical shock, in part, because Venezuela has little impact on the global economy.

“Ultimately, the Venezuelan economy is small relative to the U.S. and the global economy, with a GDP of about 0.1 percent of world GDP. Despite large oil reserves, Venezuela also only accounts for about 1% of global oil production,” said Betz, whose research examines how international economics influence global politics and vice versa.

Another likely reason why the special operation in Venezuela did not make waves in the markets: There’s already so much uncertainty around the world. Given escalating geopolitical tensions worldwide — including a growing rift between the U.S. and the European Union (EU) on a range of issues — Betz said it’s difficult to envision that a special operation in Venezuela that was billed as a limited replacement of the nation’s top leader, rather than state-building or regime change, would add much additional strain to these economic relationships.

Finally, in general, firms are increasingly aware of geopolitical risk today, which already has led to a reorientation of global supply chains, Betz explained.

Looking ahead

‘I don’t see markets shrugging off military action toward Greenland in a similar fashion, though, given that Denmark is a NATO ally and EU member.’

Timm Betz

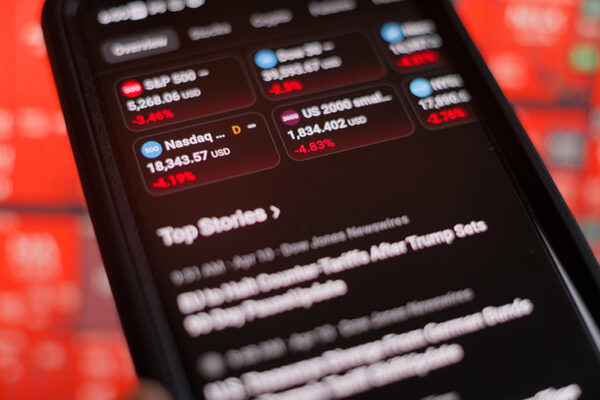

But that’s not to say that the markets and economy are on firm ground. Just like a single spark can ignite a devastating wildfire, one wrong move could send the market into a tailspin and cause economic ripples around the globe, Betz warned.

“It appears that the administration already feels emboldened by the operation in Venezuela. The increasingly offensive posture toward Greenland is perhaps the most visible consequence,” Betz said.

“Perhaps the administration is just using that posture to gain other kinds of concessions. I don’t see markets shrugging off military action toward Greenland in a similar fashion, though, given that Denmark is a NATO ally and EU member.”

President Donald Trump has been open about his plans to seize control of Venezuela’s oil exports following Maduro’s capture. So what economic factors could be influencing the president’s focus on Greenland?

“Greenland is abundant in critical raw materials, including rare earth elements and minerals,” Betz said.

“In an interview in the New York Times, President Trump highlighted the importance of how ‘ownership gives you things and elements’ not otherwise available. It is not clear what ‘elements’ he is referring to, but access to critical raw materials has been an important part of this administration’s national security strategy.”

Greenland also will be potentially important in future shipping routes through the Arctic, Betz said.

“In the past few years, we have seen the importance of chokepoints in international trade, like the Suez Canal — where a container ship blocked passage for almost a week in 2021 — and the Houthi attacks in the Red Sea in 2023. These incidents underscore the importance of key routes for maritime container trade,” he said.

How foreign policy could impact U.S. businesses, economic interests

The EU and its member countries have been reluctant to respond to U.S. aggression so far because they need U.S. aid to support Ukraine.

“Recently, a German member of Parliament, for example, even suggested accommodating President Trump on Greenland ‘to some extent,’ pointing to the continued reliance on the U.S. in the context of NATO,” Betz said. “While that was quickly rebuked and dismissed by other political figures, it shows that there’s a certain unease with standing up to the U.S. too forcefully at the moment.”

While it’s unlikely that the EU will hit the U.S. with economic sanctions similar to those enacted against Russia, Betz said countries are actively trying to reduce their potential economic vulnerabilities, which could affect U.S. interests down the line.

“EU members have, for example, seen Visa and Mastercard suspend operations in Russia in response to the invasion of Ukraine. That has sped up the development of an alternative payment system. Consumers have also engaged in ‘buycotts’ of U.S. products for a while now. A recent survey also showed that German citizens, for example, view the U.S. as a barely more trustworthy partner than Russia now,” Betz said.

“All this might not amount to sanctions, but it eventually adds up to actual, tangible costs down the line,” he added.