Billions of people worldwide, particularly those in developing countries, face challenges saving money. They may already hold a device that can assist them in the palms of their hands: their cellphone.

In collaboration with a mobile network provider in Afghanistan called Roshan Telecommunications, three researchers, including Tarek Ghani, assistant professor of strategy at Olin Business School at Washington University St. Louis, designed a mobile money-based savings wallet that could “nudge” people into saving. This study, co-authored by Joshua Blumenstock of the University of California, Berkeley, and Michael Callen of the University of California, San Diego, is forthcoming in American Economic Review and was highlighted in Harvard Business Review June 15. The full study can be read here.

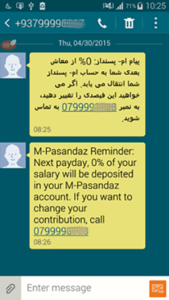

Naming their product “M-Pasandaz” (“Pasandaz” means savings in Dari), the researchers deployed and evaluated their product in Afghanistan — a country where only 1-in-10 adults have a bank account, and where only 1-in-25 people actively use an account.

They started their experiment with 949 Roshan employees who were already receiving their salary via mobile money. (Mobile money is a system that allows customers to change currency for e-float, which can then be transferred to any peer on the network or used to purchase goods.) The study involved a broad range of Roshan’s employees working across the country and working in jobs ranging from janitor to security guard to engineer.

Employees could contribute up to 10 percent of their monthly salary into their account. They also were randomly assigned to receive either a 0 percent, a 25 percent, or a 50 percent matching contribution. These paid out at the end of a six-month trial period. Employees could access their principal at any time, but the employer match was only provided after 6 months.

Employees were either randomly “defaulted in” to a contribution level of 5 percent or defaulted out at a contribution of 0. Simply defaulting employees in increased their participation in the plan by 40 percentage points. To achieve a similar level of participation using financial incentives alone, if employees are defaulted out, would require providing a 50 percent match.

Over the six-month study, the average participating employee accumulated 38.9 percent of their average monthly salary, or 12,615 Afghanis, and employees without a match as an incentive saved 18 percent of a month’s salary.

To test whether the employees’ experience of having part of their salary directed into a savings wallet created a lasting change to behavior, the researchers asked every participant at the end of the study whether they would like to continue having a portion of their salary directed into the account. Employees who had been defaulted in at the start of the study were 25 percent more likely to continue contributing to the account than employees who had been defaulted out, suggesting that automatic enrollment had helped employees learn about the benefits of saving.

There are roughly 400 million mobile money users worldwide, many of whom receive salaries or cash transfers, or are regularly involved in transacting goods. This creates a tremendous opportunity for products like M-Pasandaz to be deployed, particularly in developing countries, where the benefits may be the largest. This takes a deep, important insight from behavioral economics exhibiting that defaults impact behavior, and provides a platform for this insight to be used to increase savings globally.

Said Olin’s Ghani: “There are many barriers to saving, and previous research from high-income countries shows that default enrollment into automatic savings plans is very effective at increasing deposits. Our findings are the first to find similar effects in a low-income country context and suggest that automatic enrollment could have a broader application than previously thought. Combined with the rapid proliferation of mobile money, there is real potential to meet the financial needs of individuals in developing countries.”

The researchers believe theirs was the first study to experimentally compare default savings and incentive effects on the same population for a single product. The study also helped to shed additional light on why such default programs work through an additional set of follow-up experiments aimed at moving employees away from their default contribution level.

The researchers found, among other facets, that a larger employer’s matching contribution isn’t necessary for a successful savings plan. By focusing the experiment on one of the world’s poor countries, they showed how changing behaviors to increase savings — incentivized or not — could be significantly beneficial to its people.

Afghanistan’s per-capita GDP ranks 156th of 175 countries, at $1,877 in U.S. dollars. However, it should be noted that the study group included salaried employees earning the equivalent of $5,415 U.S. The poorer employees in the sample, though, were comparable to the broader Afghanistan population and showed clear, positive effects from the automatic contributions, the researchers said.