As Americans receive their 2017 tax statements and begin the slow march to filing their last under a fading tax system, as President Donald Trump concludes his first State of the Union with a great emphasis on the economy, as the world watches this country undergo tectonic changes, it’s time to cut through the politicking and positioning.

Washington University in St. Louis compiled researchers and experts across campus to attempt to put it into perspective, plainly speaking.

What does the new Tax Cuts and Jobs Act mean to the taxpayer?

One Washington University in St. Louis business researcher believes it will lessen the attractiveness of homeownership and mortgages — in addition to making an impact on your health insurance.

What does it mean to CEOs and C-Suites, and will it trickle down to the worker and the overall health of the economy?

Another researcher and expert from the Olin Business School forecasts that big businesses, already swimming in cash, will chiefly direct their newfound millions and billions to shareholders and continued stockpiles … even while a handful of companies have announced small, one-time bonuses or hourly increases. Apple, for instance, appeared to announce that it intended to invest less — almost half as much — in capital spending over the next five years under the new tax system as it did in the past five years.

What does it mean for Congress?

A Capitol Hill expert from Arts & Sciences and the Weidenbaum Center on Economy, Government, and Public Policy considers it the victory that Republicans needed, given their successive failures to repeal and replace Obamacare early in the Trump Administration. Yet it may cost them with the general populace and at the polls.

What does it mean, period?

Faculty members from Arts & Sciences, Olin Business School, the School of Law and more contribute to the conversation.

Republican Congress got tax-bill victory, but at what price? Tax reform reinforced the party’s “image as the party of the rich,” yet it might revive and rally the Republican Congress with their base of “activists, organized interests and donors, who were very frustrated with the party by the fall.” So writes Steven S. Smith, the Kate M. Gregg Distinguished Professor of Social Science and director of the Weidenbaum Center on the Economy, Government, and Public Policy.

Plan will reduce the allure of home ownership: Changes to the system, such as effectively removing the mortgage tax deduction and interest on home-equity lines of credit, will have a spiraling effect that ultimately impact on further borrowing. To Radhakrishnan Gopalan, associate professor of finance at Olin, their research shows that this all could lead to a decrease in housing prices, which translates into less ability for households to borrow against equity and further undermining the American dream of home ownership.

This tax reform also could have a chilling effect on the millions of Americans insured under the Affordable Care Act, he writes: “By getting rid of the individual mandate, the tax law may encourage healthy-individuals to not get health insurance. This turn of events likely will increase the premium for those who continue to purchase ACA health insurance.”

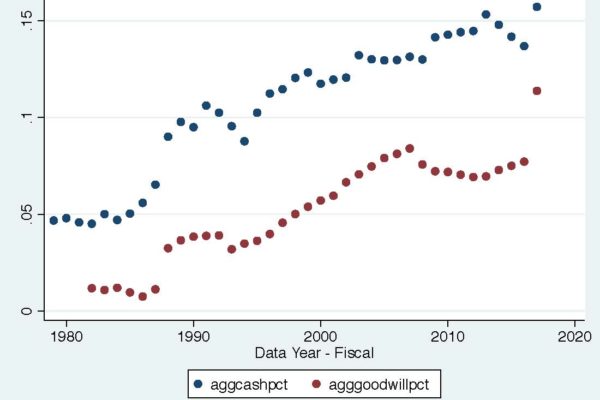

CEOs didn’t ask for this, but they’ll take it to the bank and shareholders: Despite a few big businesses announcing $1,000 bonuses or hourly wage hikes to workers, there is little in this tax plan to incentivize CEOs and C-Suites to put their newfound money where it drives the economy, wrote Anne Marie Knott, professor of strategy at Olin.

As she put it: “In order for the tax cut to increase growth, firms needs to invest in real growth, rather than the acquisitive growth we have seen in recent years. This comes in the form of expanding into new markets, or increasing the value of things produced for those markets through Research & Development. R&D is the primary driver of company and economic growth. In fact, economic theory holds that the growth rate will double if the level of R&D doubles.”

What about poor corporations? The tax package favors rich corporations over poor people, but what about poor corporations? Adam Rosenzweig, professor of law and an expert on federal income and tax policy, believes the corporations that are losing money — perhaps at no fault of their own due to, say, a natural disaster — will suffer from the new tax laws that act like “kicking someone when they’re down.” Rosenzweig’s perspective was previously published when President Trump enacted the reform package into law.