The unintended consequences of tinkering with online prices

A new paper by a team of researchers — including two faculty from Olin Business School at Washington University in St. Louis — shows the practice of dynamic pricing can generate unintended consequences by changing the behavior of customers.

Super Bowl ads aim for social responsibility

Prepare for a Super Bowl broadcast rife with social-issue and cause advertisements, because that’s what younger generations — read: consumers — want from a Sunday less about football than marketing, says Olin sports marketing expert Patrick Rishe.

How a boss can get too close with workers

Researchers, including a postdoctoral fellow at Olin Business School, have studied where potential relationship problems exist between managers and employees who are close, and how to avoid such pitfalls.

Study: Live in the moment, don’t selfie or snap it

If an event is otherwise highly enjoyable, pausing to take photographs will detract from a person’s engagement and enjoyment … and potentially affect the business visited, according to research by a team that included Olin Business School’s Robyn LeBoeuf.

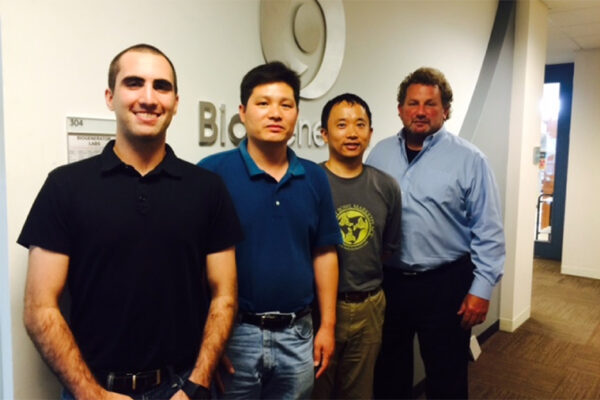

Engineering a third option

Working with budding local tech companies can be good for researchers, good for startups and good for the local economy — even if, in the end, the researcher decides to head back to the lab. Here’s the story of what one PhD student is learning about his options.

An entrepreneurial drive

As a student, JD Ross, BSBA ’11, BS ’11, ran two businesses. Ever entrepreneurial, after graduating from the university, Ross created a new way to sell homes with Opendoor.

Kickstarter fundraising and the power of helping projects

New research from Olin Business School on crowdfunding websites discovers that projects actually raise money faster just before they reach their funding goal.

Emanuel, panels lead discussion on health-care innovation

The issue of ever-changing health care, particularly drug discovery, care delivery and introducing new technologies, will be the topic of a morning-long symposium Jan. 23 at Washington University in St. Louis’ Olin Business School as part of the David R. Calhoun Lectureship.

Foes of genetically modified foods know less than they think, study finds

The people who hold the most extreme views opposing genetically modified foods think they know most about GMO food science, but actually know the least, according to new research involving a Washington University in St. Louis faculty member in Olin Business School.

Federal workers to be less efficient upon return

When 800,000 government employees eventually return to work after a shutdown that started Dec. 22, expect them to work less efficiently — or, at minimum, feel less engaged and far less respected, says an expert in government leadership and organizational strategy at Olin Business School.

Older Stories