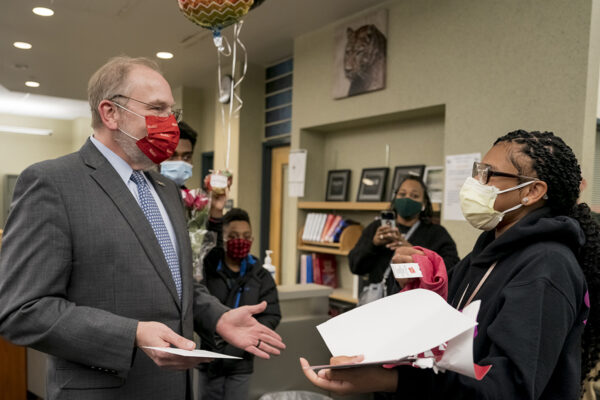

After a shaky launch, the new 2024-25 Free Application for Federal Student Aid (FAFSA) is now accessible and largely bug-free, said Mike Runiewicz, assistant vice provost and director of Student Financial Services of Washington University in St. Louis. Here, Runiewicz explains what families need to know about the new FAFSA and how the new federal financial aid formula may impact financial aid awards for college students.

Families who tried to fill out the FAFSA during the form’s soft launch in early January found the process frustrating. What went wrong, and has the Department of Education fixed the glitches?

Ultimately, the FAFSA is going to be simpler, but this transition year has been a pain point for the Department of Education, students and financial aid offices. For the past several years, the FAFSA has been released on Oct. 1. Federal law, however, doesn’t require the FAFSA to be available until Jan. 1 and as that day got closer, it became clear the department would have to release something. What we got was a soft launch that was only open for periods of time during the day. That was incredibly frustrating for people who hopped on the site as soon as the FAFSA was available. Since then, the department has made technical changes and updates and the site is now pretty stable. So if you haven’t already, now is the time to file.

How is the filing process different?

The goal of the new FAFSA was to make it easier to fill out and, indeed, there are many fewer questions to answer. But it is more difficult to complete the FAFSA in a single sitting if you are filling it out for the first time. Those families are required to set up their student aid ID in advance of completing their FAFSA. Only after the ID has been authenticated — which takes about two days — can you log in and use the FAFSA. Another point: All contributors on the FAFSA — the student and, typically, the parents — need to have their own FAFSA ID and complete their portions independently. So my biggest piece of advice is to get the student aid ID early.

In addition to a new FAFSA form, there is a new financial aid formula. How do you expect this to impact aid awards?

The Department of Education expects that the number of students nationally who are Pell-eligible will increase significantly. What we don’t know is how schools will respond. WashU and many other private schools use the CSS profile to determine aid. And at WashU, we meet 100% of demonstrated financial need, so the change to the federal aid policy will not change how we determine our financial aid awards.

But there are a lot of schools that only use the FAFSA to determine eligibility for need-based aid, and we don’t know what they will do. If they are able to dedicate additional resources to financial aid they will be able to support the additional students who are now eligible for Pell Grants. If not, they may need to reduce aid across the board to meet their budgets. We just don’t know, and that could lead to some surprises. My best advice to families is, if they get a financial aid offer from any school that makes that school unaffordable, reach out and talk to that school to see if anything can be done.