In the coming years, nearly half of small and medium-size business owners are expected to retire. As a result, an estimated $100 trillion in combined personal assets and company net worth will be passed on to successors, transferred to new owners or sold.

The effect of this unprecedented wave of ownership transitions — sometimes called a silver tsunami — combined with the rise of private capital investment in these markets, will ripple throughout communities and the economy, according to new research from Olin Business School at Washington University in St. Louis and the Brookings Institution.

Despite the inevitability of these transitions, many owners are unprepared. Recent research has shown that more than 85% lack a formal succession plan, according to Peter Boumgarden, the Koch Family Professor of Practice in Family Enterprise at WashU Olin.

Without thoughtful planning and policy interventions, local and federal governments could be unprepared for the inevitable transition, too, putting businesses, jobs, community cohesion and local economies at risk, Boumgarden added.

With generous support from The Bellwether Foundation Inc., the Olin Brookings Commission — led by Boumgarden and Aaron Klein at the Brookings Institution — has studied this trend over the last year, paying particular attention to three key stakeholders in the transition: investors, owners and employees.

They presented their research findings, as well as a set of policy recommendations to aid the transition, Oct. 8 at the Brookings Institution in Washington, D.C.

“Fortunately, this silver tsunami does not have to be a man-made disaster,” Boumgarden said. “As ownership changes hands, there is a significant opportunity for us to reimagine ownership structures, including increasing employee ownership, promoting long-term investor behavior and fostering greater inclusivity in business leadership.”

Examining investors, owners, employees’ perspectives

To fully understand and identify areas for policy innovation, it is essential to consider the preferences of business owners, the effects on employees and the broader policy implications, Boumgarden said.

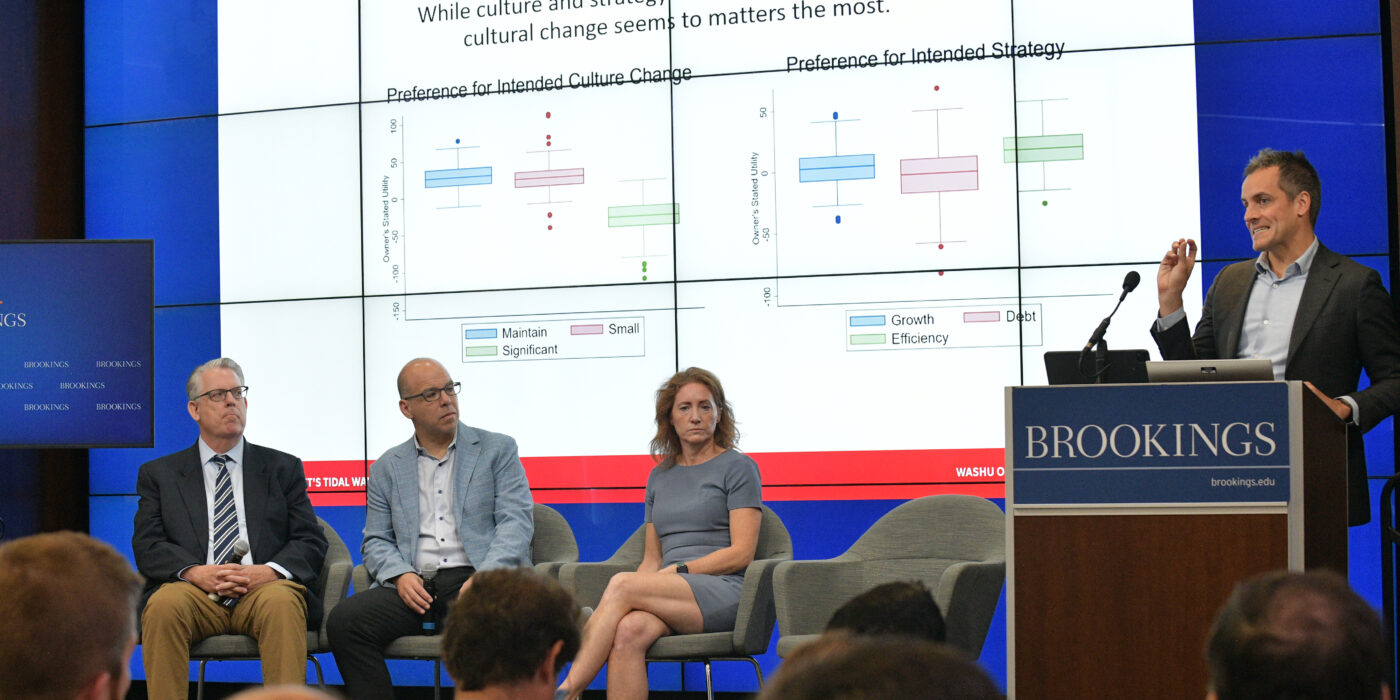

The commission interviewed and surveyed private investment professionals to understand the strategies they use when investing in the lower market. With the help of US Bank, ENOVA and Edward Jones, they also surveyed nearly 200 small and medium-size business owners about their preferences for sales.

Finally, the commission tracked the outcomes for nearly 500 current and former employees of firms that went through various types of ownership transition — employee ownership, family transition, competitor purchase and private equity purchase. They had these individuals reflect on the quality of their jobs changing over a five-year period. These employees rated the experience post-transition based on their perceptions of job quality, company culture, stability and security and work meaning or purpose.

Key findings from that research include:

- The strategies of investors in small and medium-sized enterprises differ meaningfully from the investment behavior of those with large targets. When small and medium-sized enterprise owners sell, it’s often to a family member, an individual buyer or a competitor, though private equity investors are showing increasing interest in entering the lower middle market. In the survey with investment professionals in and around this market, the study found acute differences in strategies pursued post-investment: Private-equity investors are most likely to focus on a high-value exit and pursue aggressive strategies to increase revenue and cut costs; employee ownership models were less aggressive across most strategic levers, except in the focus on improving incentives, as one example. Even family office investors tended to pursue a different approach than both private equity and competitor purchases.

- Perhaps not surprisingly, owners placed the most emphasis on the deal’s financial value. But other factors such as the nature of the buyer — private equity, family, employee, competitor — and concerns about changes to culture and strategy also mattered, to the point that the owner could take a lower financial offer. They were especially concerned about selling to competitors or buyers who planned to institute significant changes in company culture.

- Family and employee ownership models appeal to owners, likely due to their likelihood of preserving company culture.

- Not surprisingly, they found that all ownership transitions were hard on employees. That said, some transitions were more employee-friendly than others. In particular, companies that transitioned to employee ownership models offered the best and most stable outcomes for employees over five years. More than 80% of these employees stayed with the company for at least five years, compared to numbers closer to 60% for the other groups. They were also the only group to report long-term improvement in job quality.

- Employees at companies purchased by competitors fared the worst — just 61% of these employees stayed at their job for at least five years, and they reported the biggest declines in job quality and work meaning or purpose.

“The thing that jumped out to me the most from the data is that people do not want to sell to their competitors. The competitor ranked below private equity,” said Klein, who is the Miriam K. Carliner Chair–Economic Studies at Brookings and a senior fellow for the Center on Regulation and Markets.

“We tend to believe that utility equates to dollars. But when you talk to real people, you see the economics of spite. People really value spiting people that they don’t like. People don’t want to sell to the people they competed against locally.

“Policies aimed at keeping the value in the community will bump up against this natural tension that occurs with owners. It’s the biggest counterintuitive finding from this study and why talking to the owners, and not just observing transactions, provides new insights.”

Another illuminating finding to emerge was the impact that different investor strategies had on employee outcomes. Long-term investments in improving corporate governance, incentives and information systems have a positive impact on employee outcomes. Shorter-term strategies such as reducing cost and changing leadership negatively impacted employees.

“These findings suggest that the type of transition is not as important as the specific strategies employed by these new owners. One way to encourage better outcomes for employees would be to incentivize longer-hold strategies,” Boumgarden said.

Research highlights policy opportunities

From this work, the commission identified robust policy opportunities, which they say could help ease the impact of ownership transitions by protecting workers, sustaining communities and fostering a more inclusive and resilient economy.

These recommendations fall into four policy bundles:

- Stemming the tsunami: The first bundle of policies focuses on increasing the attractiveness of small business ownership through targeted support and tax incentives, particularly for rural and minority-owned businesses. Currently, there are at least seven bills at various stages in the U.S. House and Senate that would address this need, including HR 7024 – Tax Relief for American Family and Workers Act (2024), introduced by Rep. Jason Smith, R-Mo., and S. 4764 – Coordinated Support for Rural Small Businesses Act, introduced by Sens. Jeanne Shaheen, D-N.H., and John Kennedy, R-La.

- Promoting dual-purpose ownership: Given the generally positive outcomes for employees in firms that transition through generations, the commission recommends policies that support this continuation and models that balance profit and other social purposes. These policies would allow businesses to maintain community- and employee-centric values, the commission said. For example, the commission suggested creating there might be potential in creating a state-designed family corporate status to level the playing field for smaller family-owned businesses and enable lawmakers to offer incentives such as low-cost loans, tax subsidies, bidding preferences for government contract work and free counseling. They also highlighted the success of larger groups, like Patagonia and Hershey, that have modeled dual-purpose foundation ownership.

- Expand opportunities for employee ownership: The committee recommended expanding pathways to employee ownership through legislation like the Promotion and Expansion of Private Employee Ownership Act of 2023, which aims to incentivize business owners to sell shares to employee stock ownership plans, allowing employees to become part-owners of their companies.

- Incentivizing long-term investor behavior: The commission recommended tax incentives to encourage long-term investment strategies, reducing the risks associated with short-term ownership transitions that can destabilize firms and negatively impact employee outcomes.

“When you look at all this legislation currently on the table, you realize how bipartisan this issue is,” Klein said. “I worked in the Senate for eight and a half years and you don’t see an issue as bipartisan as small business, particularly regarding transitions.

“No one here knows what the outcome of the election will be, but we do know that this tsunami is coming. Regardless of who wins the election, both sides are interested in addressing it, and they are starting to find common ground. That makes me optimistic that the door for policy change to occur is opening and is going to be wider in this space than almost anywhere else.”

In addition to Boumgarden and Klein, other commission members include Brendan Ballou, author of “Plunder: Private Equity’s Plan to Pillage America”; Ronnie Chatterji, the Mark Burgess & Lisa Benson-Burgess Distinguished Professor at Duke University; Lynn Gorguze, president and CEO of Cameron Holdings; and Mike Mazzeo, dean of WashU Olin Business School. Daryl Van Tongeren, of Hope College, contributed to the work, and in particular the focus on employee outcomes and the meaningfulness of their work.

Additionally, the following Olin researchers contributed to the work: John Barrios, assistant professor of accounting; Seth Carnahan, associate professor of strategy; Bart Hamilton, the Robert Brookings Smith Distinguished Professor of Entrepreneurship; Margarita Tsoutsoura, Olin associate professor of finance; and former Olin PhD student, now an instructor at the University of Iowa, Julie Lee.