On June 13, the Bureau of Labor Statistics released updated inflation figures showing that the Consumer Price Index grew at a 4% annual rate in May. The difference in consumer prices from April to May, however, was just 0.1%. These two numbers paint very different pictures of the current state of inflation and the American economy.

The confusion comes from the way in which we calculate inflation, according to John Horn, a professor of practice in economics at the Olin Business School at Washington University in St. Louis. Horn earlier explained how the “math” of inflation works.

“As a refresher, inflation is an annual measure — the increase in prices over 12 months,” Horn said. “The Bureau of Labor Statistics creates a representative basket that an average person would buy, then calculates the price for that basket. The formula for inflation is:

“That’s just the definition of a percentage change: the change over time divided by the initial value. Using this formula means inflation can increase really fast but has a hard time coming back down. That has nothing to do with economics; it has everything to do with math.”

Take a very simple example. Say the monthly price for the basket of goods is $100 every month and has been for a couple of years. That means inflation is 0%, since (100-100)/100 equals 0%. If the price suddenly increased to $110 in January, then inflation would be 10% because (110-100)/100 equals 10%.

But here’s how annual inflation numbers can distort the economic reality: If prices stayed flat in February, then the price of the basket would still be $110, and inflation would be: $110 (current February’s price)-100 (last February’s price)/100 (last February’s price). That’s 10% again. And in March, if prices stayed flat at $110? Then current March equals $110, last March equals $100, so inflation is (110-100)/100, which equals … 10%.

In this simple scenario, there was a one-time fast increase in prices and then prices stayed stagnant for a full year, but the lag in inflation calculation would lead to 10% inflation for a full year.

“This is troublesome because the news reports and headlines would scream, ‘Inflation stays stubbornly high at 10%,’” Horn said. “That’s true, but in terms of buying power, there was only a one-time increase in prices. For the rest of the year, prices stayed flat — admittedly, at an elevated rate. And that’s assuming prices remain stagnant after January. Even in a healthy economy, we expect prices to rise modestly — typically around 2% annually.”

“When prices continue to rise modestly after a one-time spike in prices — as they did in 2022 — it can make the situation seem much worse than it really is,” Horn added.

Perception versus reality

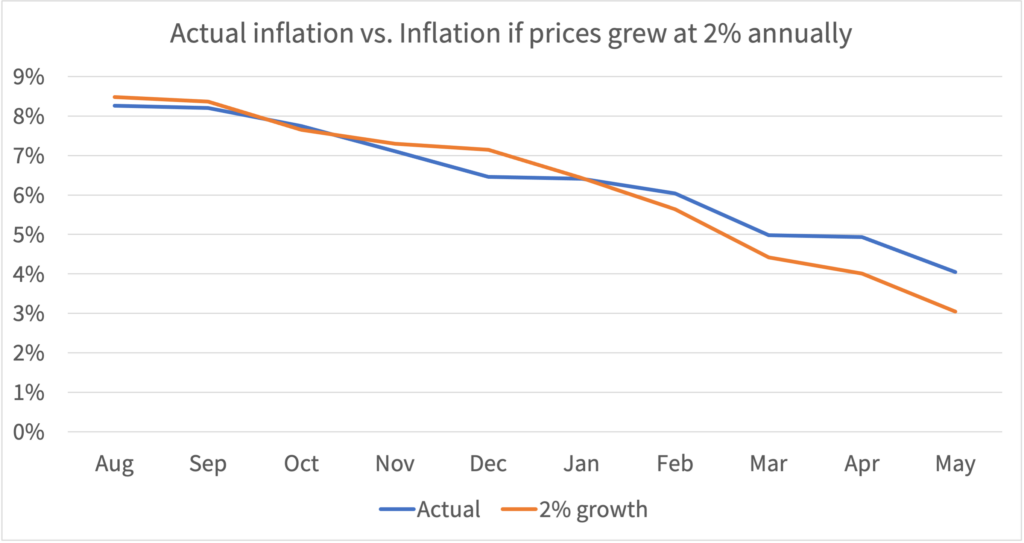

The latest Bureau of Labor Statistics figure shows inflation for May 2023 was 4% — good, but still above the Fed’s target level of 2%. What should inflation have been if prices had started rising at 2% starting in August 2022?

“Under this scenario, the annual inflation rate in May would have been 3%,” Horn said. “Is that below the 4% we’re actually at? Sure, but not that far off to think we’re wildly stuck in an inflationary economy. In fact, since December 2022, we’ve been off this 2% trendline by about 0.5 to 1% each month — pretty steadily, in fact. We are running only slightly ahead of where we should be.”

“Overall, inflation is not running away — as you can see in the chart — it’s gliding back to the path we’d like to see of around 2%,” Horn said.

When thinking about the economy, and inflation in particular, Horn said it’s important to not fall into “base rate fallacy” thinking by focusing too much on specific details — like the prices of commercial real estate, used cars or eggs — and ignore the larger-picture trends. For example, there are some worrying trends in rental rates, since those prices are rather sticky for longer periods of time, baking in those changes into inflation for longer. But those changes are often offset by changes in other products’ prices in the overall basket.

While rental prices are currently keeping inflation up, unemployment — which is often mentioned as a driver of higher inflation — has stabilized at the rates we saw right before the COVID-19 pandemic, when inflation was right around the Fed’s target of 2%, Horn said.

Looking back to last summer, Horn pointed out that many feared the Fed would either overcorrect by raising interest rates too high, which would throw the economy into a recession, or it was going to undercorrect and raise interest rates too little and create endemic inflation that would never come down.

“No one had great confidence that the Fed could achieve the soft landing, whereby the economy didn’t enter a recession while inflation slowly came back down to the 2% target,” he said. “We clearly didn’t have a recession, and while we’re still about a percentage point too far above the tarmac, the plane appears to be on an approach glide path.

“At least, if we take a longer view and remember the math behind inflation,” Horn said.