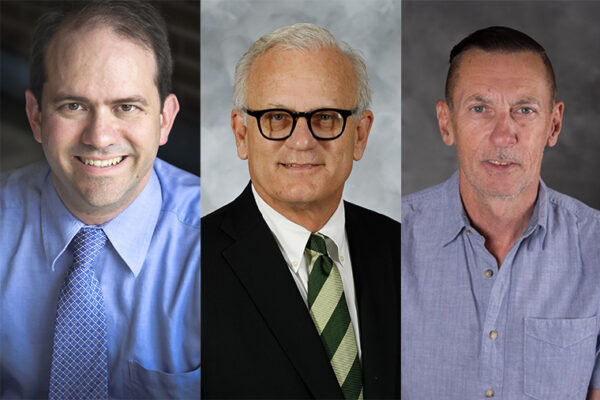

Some economic observers continue to warn about signs of a potential U.S. recession. Glenn MacDonald, the John M. Olin Distinguished Professor of Economics and Strategy at Olin Business School at Washington University in St. Louis, said many signs aren’t particularly reliable — but keep an eye on housing starts.

MacDonald discussed signs of a recession and whether he foresees one anytime soon. He doesn’t, but he cautioned that history shows it’s not a question of if but when.

Where do recessions come from?

Much like earthquakes, we know a great deal about business cycles, but we don’t really know how to predict their arrival. Sometimes we can tell ourselves a story after the fact. But we don’t know whether those stories are correct.

People might blame the previous recession on the financial crisis?

The weakening housing market in 2006 precipitated the financial crisis; gross domestic product (GDP) growth was already shrinking when the housing market weakened. It’s not that the financial crisis caused the weakening housing market. It’s the other way around.

There are plenty of candidates for the cause of the most recent recession, including the high and rising level of government debt. But economics isn’t like physics, where there are certain rules that apply because, for example, the speed of light is a certain number. However, empirically, around the world, when government debt reaches something like a whole year’s GDP — that’s a noteworthy point. And the U.S. was getting there at that time, which many saw as a great cause for concern. The debt-GDP ratio has remained high, and, so far, the more frightening scenarios have not transpired.

One thing thought to predict recessions is an inverted yield curve, like occurred earlier this year, right?

Statistically there is a correlation between yield curve inversions and eventual onset of recessions. However, the connection between them is quite loose and difficult to employ to predict recessions confidently. For example, the yield curve was inverted for much of 2019 — suggesting a recession might be coming. But it is no longer inverted — suggesting the opposite.

When you see housing starts tailing off, that does tend to be a sign of trouble. And the reason for that is simply that the trouble has already started, as in 2006. So you are not really predicting a recession as much as noticing it early.

How are housing starts doing?

They were really, really strong in September. They’re not going as fast as they were going. But they’re still going.

We’re experiencing a long expansion. Should we be worried?

In a business cycle, proceeding from a trough to a peak is an “expansion.” On average in the postwar, U.S. expansions been about five years long. So when people look at this 10-year expansion that we’ve just completed, they think it’s really long. But there is a lot of variability in expansion length. For example, the expansion that started right around 1990 also lasted 10 years.

Recognizing this variability in expansion length, the data suggest that the bulk of expansions would be less than 10 years in duration. So if you said, “It’s kind of like we’re almost overdue for a recession,” that would be consistent with the facts. But that idea is based on just 11 recessions and an economy that has changed drastically since the postwar, so making confident predictions about such a rare event is impossible.