The current volatility of the U.S. stock market is no cause for alarm, but a Washington University in St. Louis expert who helped to create a volatility index knows the difficulty in predicting whether fluctuations such as the current one will subside quickly or slowly.

“In hindsight, yes, we should have seen this coming,” said Asaf Manela, associate professor of finance at Olin Business School. “But market participants have been raising concerns that volatility is very low by historical standards for about two years now. It is hard to time volatility spikes.”

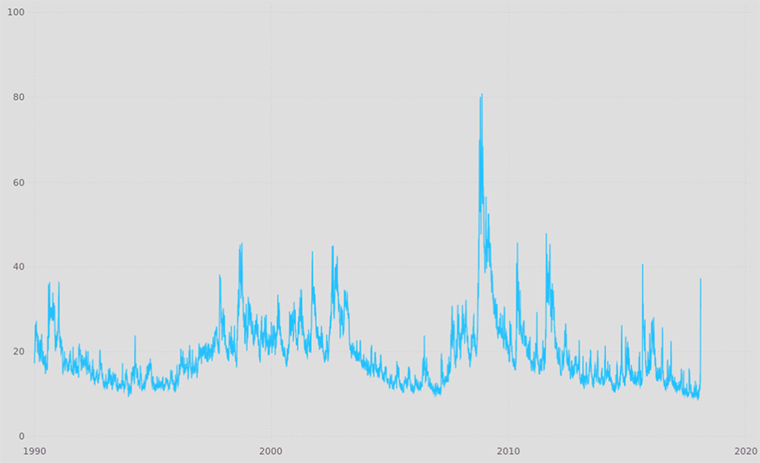

Manela noted that history shows such stock-market plunges happen over time. In fact, the decreases in recent days, including the 666-point drop in the Dow on Feb. 2, followed by a more than 1,000-point plummet Feb. 5, is only the fourth-worst spike of volatility since a 2009 record high, according to the Volatility Index ( VIX) published by the Chicago Board Options Exchange.

The VIX, a calculated monthly measure of the market’s expectation of volatility implied by S&P 500 index options since 1990, has become a key point of discussion in these recent days of markets fluctuation.

Citing the chart shown above, Manela points out two things: “First, VIX tends to spike and gradually decline,” Manela said. “Second, Monday’s spike is quite large relative to the 1990-to-present history of the VIX and follows a period of relatively low volatility.”

Manela helped to create a volatility index that goes back a century further in history — to 1890. He and co-author Alan Moreira of Yale University shared their news-based variant of the VIX, which they call NVIX, in a recent paper published in the Journal of Financial Economics called “News Implied Volatility and Disaster Concerns.” They based it on news accounts from The Wall Street Journal through history.

“We find that much of the variation in VIX comes from uncertainty about the stock market itself, but such variation is not priced in the sense that it does not predict future returns,” Manela said. “By contrast, concerns related to wars or government policy drive most of its priced variation.

“In other words, if an investor believes that the current volatility spike is due to uncertainty about government or central bank policy, then our research suggests that the returns to holding stocks are expected to be higher moving forward. Returns have to be higher on average to compensate investors for bearing this policy risk.”

In the meantime, Manela used evidence and research to preach patience. Research shows that for stockholders, it is beneficial to reduce exposure to stocks when volatility is persistently higher and increase exposure when it is lower, Manela said.

“Investors may want to hang tight but only if this volatility spike is due to uncertainty about government policy, monetary policy or wars,” Manela said. “If, by contrast they think this is more about concerns about the stock market itself and this spike in volatility is here to stay, they should move some of their stocks portfolio to safer assets like treasuries.”